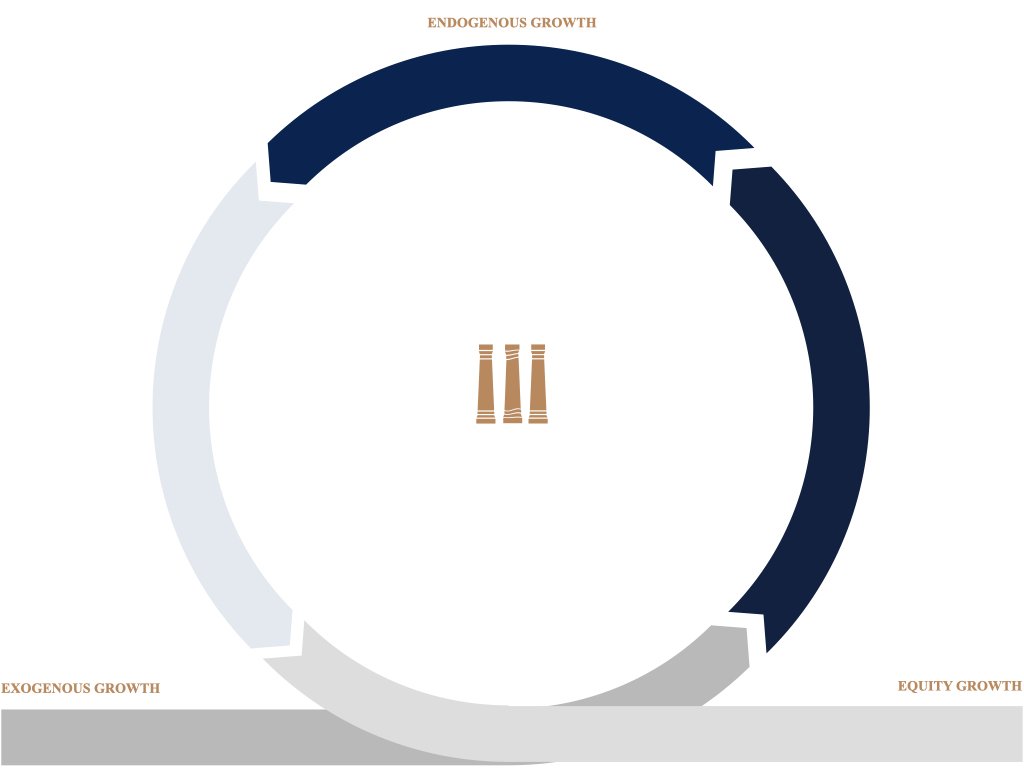

The Columbiae Group’s research is predicated on the interdisciplinary understanding that the future of work and economic value is determined by the complex post-industrial interplay between regulatory frameworks (Policy Equity), public markets (Public Equity), and private capital deployment (Private Equity). Our research agenda is to synthesize these three dimensions to provide proprietary foresight and strategic guidance.

Policy Equity

Policy Equity is the study of how governance structures - from legislative intent to regulatory design - create, constrain, or destroy value within economic systems. It moves beyond standard risk compliance to quantify the non-financial systemic value derived from effective, equitable, and adaptive policy. This area focuses on upstream and exogenous factors, treating policy frameworks themselves as assets or liabilities that must be evaluated and optimized for long-term viability.

-

Agenda: Quantifying the systemic risk of unchecked AI/ML models across different regulatory jurisdictions.

Evaluation:Synthesis of legal frameworks (liability) with computational design (bias mitigation) to develop a Policy Equity Indexfor corporate AI governance

-

Agenda: Assessing the policy risk embedded in major federal investment and infrastructure initiatives (e.g., IIJA, grid modernization, critical supply chain funding).

Evaluation: Modeling how policy fragmentation (federal vs. state permitting, zoning, and domestic sourcing requirements) translates into measurable delays, cost overruns, and structural competitive advantage for infrastructure projects.

-

Agenda: Analyzing the economic consequences of global and national data localization and privacy mandates on innovation policy and cross-border trade.

Evaluation: Developing a Data Policy Friction Index to advise on optimal network architecture and data asset valuation under fragmented digital sovereignty rules.

Public Equity

Public Equity research focuses on the intersection of publicly traded asset valuation and systemic, non-traditional performance drivers. It recognizes that traditional financial metrics fail to fully capture the value of a firm's absorptive capacity and policy alignment. This research seeks to redefine how external policy influence and internal governance architecture translate into premium valuation and sustained market performance.

-

Agenda: Quantifying the market's valuation premium (or discount) assigned to firms that demonstrate superior policy alignment and governance capacity against systemic risks (e.g., climate change, geopolitical instability).

Evaluation:Developing a proprietary Adaptive Capacity Score that correlates governance quality with lower long-term cost of capital and higher valuation multiples.

-

Agenda: Analyzing the impact of converging international reporting standards (e.g., IFRS/ISSB, CSRD) on financial statement integrity and investor behavior.

Evaluation: Creating a methodology for integrating non-financial performance metrics into discounted cash flow (DCF) models, moving ESG from disclosure to core valuation input.

-

Agenda: Studying how investor activism focused on public goods/services (e.g., utilities, essential infrastructure, anti-trust concerns) and the broader competitive structure forces changes in corporate strategy and governance.

Evaluation:Modeling the financial risk-adjusted returns associated with proactive engagement versus reactive defense against competition- and public-service-centric shareholder resolutions and regulatory actions.

Private Equity

Private Equity research addresses how capital deployed in unlisted markets drives endogenous growth and maximizes the conversion of internal capacity into self-sustaining returns. This area provides proprietary frameworks for due diligence, resource allocation, and value creation in M&A, divestitures, and venture funding, ensuring investment theses are robust against policy risk and optimized for future competitive frontiers.

-

Agenda: Developing due diligence frameworks that explicitly assess a target's Absorptive Capacity and intrinsic policy alignment prior to acquisition or investment.

Evaluation: Creating a Future Viability Score for M&A that models the impact of policy momentum and internal capability on the combined entity's projected performance, incorporating principles of developmental accounting to track adaptive progress.

-

Agenda: Analyzing the relationship between internally-driven human capital development (training, education, talent management) and accelerated value realization in private markets.

Evaluation: Developing proprietary metrics to quantify the economic returns of superior workforce development policy, linking labor strategy to faster growth and successful exits.

-

Agenda: Researching the financial mechanisms (investment, divestiture, restructuring) that translate a firm’s adaptive mastery (low risk, high capacity) into superior, self-sustaining financial performance.

Evaluation: Building models to track and report on the conversion velocity of adaptive capacity into EBITDA, differentiating returns generated from internal excellence versus external market forces.