Rational behavior, in the aggregate, should not result in societal outcomes that are inequitable. Preference to be averse to inequitable outcomes should not be viewed as only philanthropic, or, in the proverbial sense, charitable. With a compounding effect, what has been deemed economically rational has driven society’s preference to forego the most influential economic variable there is - the interdependence of its citizens. The Public Equity Fund believes that economic cohesion restores what has been lost from the incremental inequities that have built up over generations, and, therefore, the quality of life we all pursue.

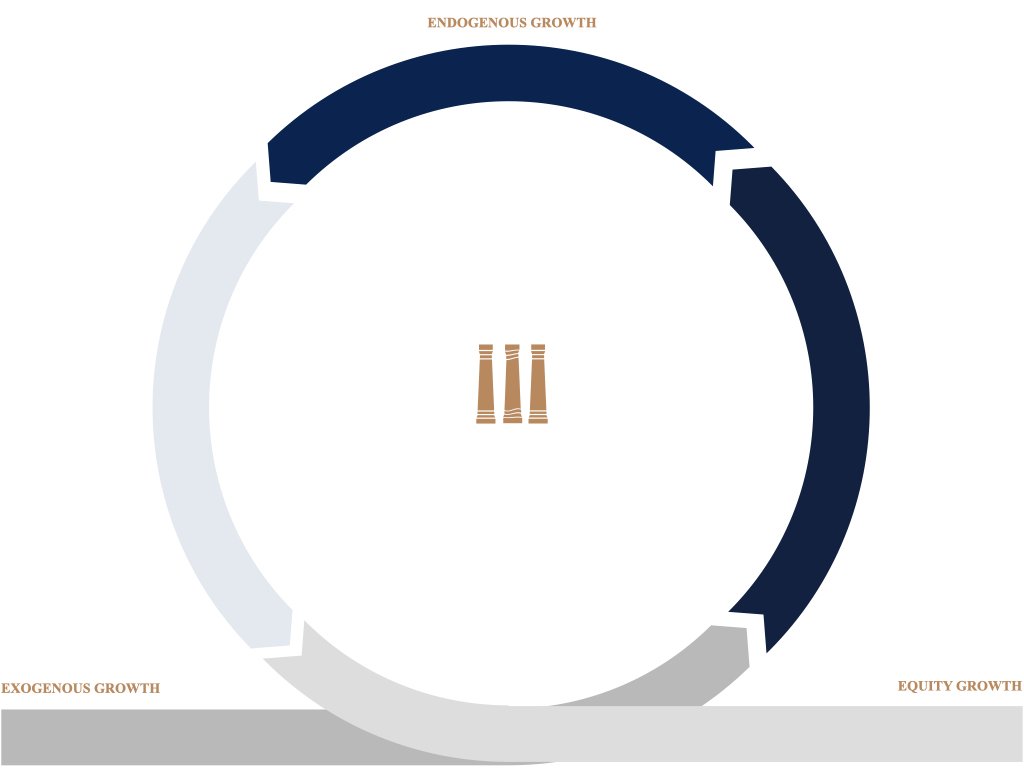

The Public Equity Fund is built on the notion of economic cohesion. Where the interdependence of citizens is the focus of economic sustainment. Specifically, rebalancing the ratio between contributions from, and benefits to citizens. Currently, this ratio presents an overwhelming imbalance between citizens contributing more than the subsequent benefit they receive. No more obvious of an imbalance than with the consumption of public goods and services. This is why PEF was founded.

Public Equity

The current economic system fails to view equitable outcomes as rational investments, relegating public goods and services to a volatile, opaque, and inefficient philanthropic sector. This results in limited Economic Cohesion, where the societal benefits generated by non-profits lack a verifiable price signal.

The core problem is the lack of competitive market mechanics. Specifically, the absence of price transparency and liquidity. to efficiently match capital (demand) with verified impact (supply). This lack of competition restricts a massive opportunity: the $2.67 Trillion US non-profit sector remains locked in a black box model.

The Public Equity Fund (PEF) aims to unlock this market. By introducing competition via a transparent, market-based structures, PEF incentivizes efficiency and innovation. This competition naturally drives capital toward the highest-performing areas of the market, creating the conditions where equitable outcomes are both the most incentivized and the most rational economic choice. This inversion achieves Economic Cohesion.

There is little influence citizens have on shaping demand for the public goods and services they consume, which severely constrains the ability to maximize utility for themselves. The absence of choice and competition have resulted in over/under-supply of ineffective public goods and services. PEF aims to remedy this by empowering equality of autonomy. Where citizens, and, by extension societies, are able to regain their influence on the public goods and services that directly impact their quality of life.

No Competition

The current ecosystem for public goods and services suffers from a core lack of market efficiency and citizen autonomy, leading to an inequitable societal equilibrium.

Market Demand: Citizens have minimal direct influence over the demand, quality, and effectiveness of public goods and services they demand (lack of autonomy). Funding is often allocated via opaque ways and means or traditional philanthropic models that lack competitive pressure - the issue of over/under market supply.

Market Supply: Traditional economic models fail to formally value the interdependence of citizens and the collective access to public goods and services supplied (lack of economic cohesion). The cost/benefit ratio for citizens is highly imbalanced as they contribute significantly more than the verifiable benefit they receive - the issue of market illiquidity.

Market Value: Traditional funding mechanisms are one-way, non-liquid, and offer no dynamic feedback mechanism to structure supply and demand productively (donor fatigue and misallocation). Public goods and services operate in silos with no competitive pressure based on defined market performance, leading to stagnation and a lack of transparency - the issue of inefficient philanthropic capital.

PEF offers a solution to these traditional problems of political science and public economics, where communities are able to generate their own demand and supply for public goods and services. As a medium of exchange for citizens, PEF enables markets to align choice and competition that reflects the absolute needs of their citizens in a more efficient and effective way. Through public equity-based funds, societies are able to generate, manage, and utilize its own wealth as they see fit.

Creating Competition

The opportunity is to leverage the dynamics of a competitive market to introduce market autonomy, liquidity, and discipline to public goods and services, creating a new, sustainable, and equitable market that incentivizes competitive supply and demand.

Market Demand: public goods and services become optimally allocated to address the absolute needs of the public goods and service market, leading to utility maximization. This breaks the cycle of over- and under-supply and inefficient supply - the opportunity to maximize public utility.

Market Supply: public goods and services value are unlocked through transparent, market-based transactions, shifting quickly from ineffective to highly effective market opportunities. This breaks the cycle of redundant, concentrated, and mismatched supply and demand - the opportunity to optimize allocative and productive efficiency.

Market Value: public goods and services, when aggregated, drives equitable societal outcomes, incentivizing the fabric and quality the market pursues. This breaks the cycle of value erosion and decreasing returns to scale on social capital - the opportunity to accumulate public equity.

Market Equity

The Public Equity Fund is not reinventing philanthropy; it is rationalizing it. The Public Equity Market allows donations to be issued as a proxy for public equity for donors.

Market Demand: allowing market-based signaling to self-regulate the issue of trust and transparency due to opaque public goods and services financial reporting and oversight. The Public Equity Market allows funding of public goods and service to self-regulate the same as shareholders, extending more opportunities to provide funding.

Market Supply: allowing market-based liquidity to self-regulate the issue of scope and scale due to public goods and services redundancies, concentrations, and mismatches. The Public Equity Market allows funding of public goods and services to self-regulate the same as equity issuers, expanding more opportunities to receive funding.

Market Value: allowing market-based public equity to self-regulate the issue of competition due to non-rivalrous efficiency and non-excludable effectiveness. The Public Equity Market allows shareholders and share issuers to self-regulate the supply and demand of public goods and services, enabling competition to realize value from funding.